Casino utan svensk licens – en översikt över de bästa casinona 2026

Att ett casino saknar svensk licens innebär inte att det är olagligt. Det betyder helt enkelt att verksamheten är reglerad av en internationell licens.

Casinon utan svensk licens och utan Spelpaus är minst lika säkra och lagliga som de som är licensierade av Spelinspektionen. Dessa casinon och bettingsidor har flera fördelar – till exempel finns det inga insättningsgränser, och bonusutbudet är oftast mycket mer generöst. Du kan få cashback, VIP-förmåner och free spins. När det gäller uttag är valmöjligheterna betydligt bredare – internationella e-plånböcker, kryptovalutor och direktöverföringar till bankkort är tillgängliga.

Vi hjälper dig att välja ett säkert casino utan svensk licens – vår topp-ranking är baserad på spelarnas omdömen och vår egen expertbedömning. Du kan tryggt spela utan oro eller misstag.

Bästa casinon utan svensk licens

| Typ av casino | Beskrivning |

| Bästa casinon utan svensk licens | De bästa casinona med bonusar och utan insättningsgränser |

| Pay N Play utan licens | Casinon utan registrering via BankID. Omedelbara uttag |

| Bästa mobilcasinon | De bästa mobilanpassade spelen. Appar för Android och iOS |

| Skattefria casinon utan svensk licens | EU-casinon med snabba och rättvisa uttag. Generösa bonusar |

| Casinon med snabba uttag | Uttag inom en timme, 0 % avgift, bonusar utan omsättningskrav |

| Bästa krypto casino utan licens | Kryptobonusar. Cashback utan omsättningskrav |

Lär dig välja online casino utan svensk licens

Redo att fördjupa dig i ämnet casinon utan svensk licens och förstå hur spelmarknaden fungerar utanför Sveriges gränser? Vi har tagit fram en detaljerad guide som hjälper dig att navigera tryggt. Den är särskilt användbar för dig som har tröttnat på Spelpaus och letar efter alternativ med bättre bonusar, nya betalningsmetoder och ett större urval av slots och sportspel. Dessa casinon har internationella licenser och låter dig spela fritt – utan ingripande från svenska myndigheter.

Regleringen av spel i Sverige blir allt strängare, och många spelare överväger att byta till ett casino utan licens i Sverige. Att spela utan Spelpaus är både fördelaktigt och säkert – men det finns vissa saker du bör känna till. Vi berättar hur du känner igen ett pålitligt casino utan svensk licens, vilka bonusar som erbjuds, hur du sätter in och tar ut pengar, samt juridiska aspekter och registreringsdetaljer du bör ha koll på för att spela tryggt.

Vad du bör veta om casinon utan svensk licens och utan Spelpaus

Här bekantar vi oss med några av de bästa casinona utan svensk licens som samtidigt är lagliga webbplatser – med höga odds, förmånliga bonusar och snabba utbetalningar. Varje casino i listan nedan är ett seriöst alternativ för svenska spelare.

Topp 10 casinon utan svensk licens och utan Spelpaus

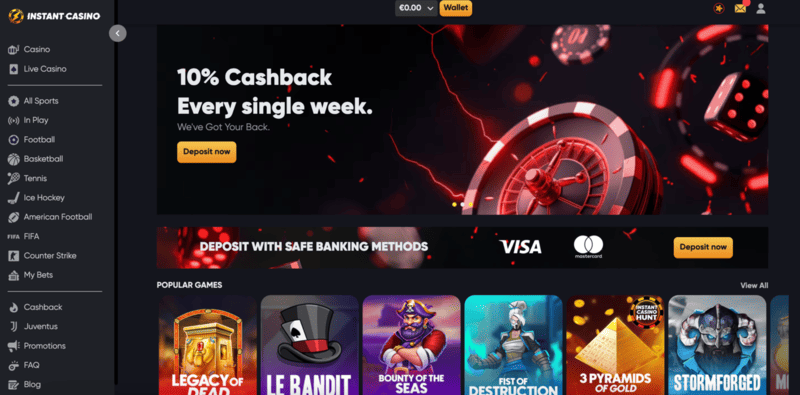

- Instant Casino toppar vår lista över bästa casinon utan svensk licens. Registrera dig nu och få en bonus upp till 7 500 € samt 10 % cashback. Med över 6 500 spel, omedelbara insättningar och snabba uttag från 20 € – helt utan Game Break eller Spelpaus – är det ett av de bästa valen för svenska spelare år 2026. Recensionerna talar sitt tydliga språk.

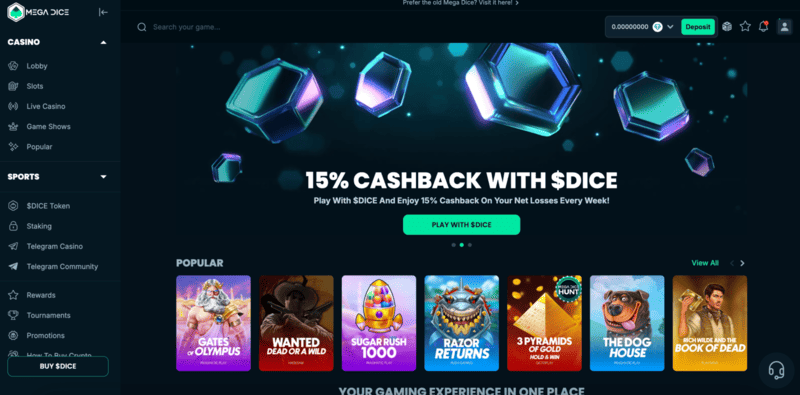

- Mega Dice är ett nytt krypto casino utan svensk licens med en snygg och modern design. Nya spelare får 200 % insättningsbonus upp till 1 BTC och 50 free spins vid registrering samt 15 % cashback varje vecka utan större krav. Över 6 000 spel, snabba utbetalningar och stöd för USDT, BTC och ETH. För sportspelare erbjuds bekväm betting direkt via Telegram-bot.

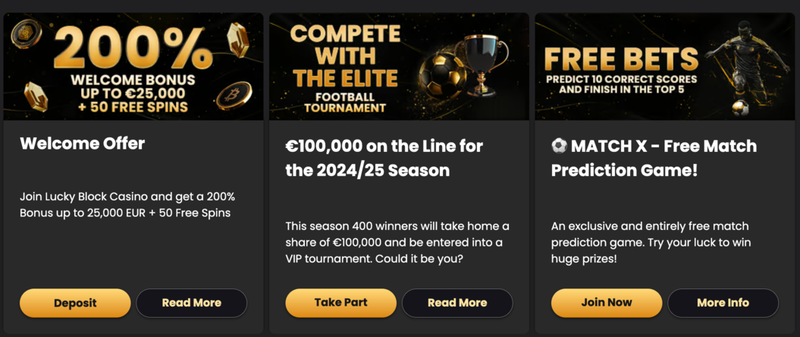

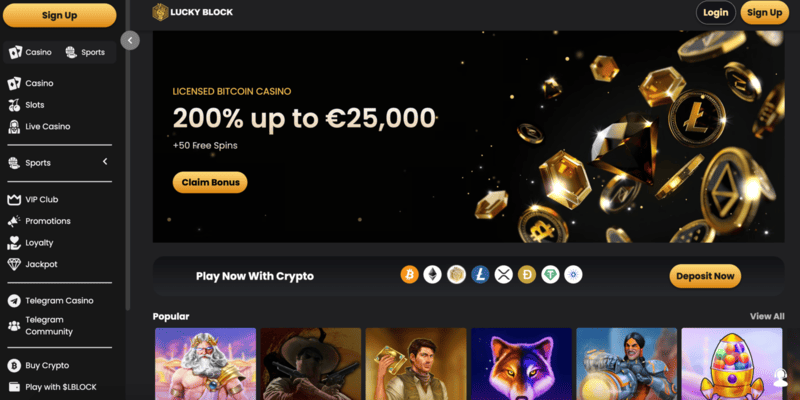

- Lucky Block är ytterligare ett krypto casino utan licens i Sverige och utan Spelpaus. Här väntar en massiv bonus på 200 % upp till 25 000 € + 50 free spins. Betalningar och uttag i kryptovaluta är fullt möjliga, men traditionella betalmetoder stöds också. Lucky Block är ett bitcoin casino som garanterar säkra utbetalningar och hög datasäkerhet.

- CashAlot är ett casino utan svensk licens som erbjuder dagliga bonusar, höga gränser och snabba uttag efter verifiering. Välkomstbonus upp till 500 € + 50 free spins, över 3 000 slots samt stöd för kort, krypto och e-plånböcker.

- WSM Casino är ett nytt licensierat krypto casino utan svensk Spelpaus. Få upp till 25 000 € i bonus som ny användare. Spela över 5 000 spel, delta i exklusiva turneringar och ta del av ett lojalitetsprogram för VIP-medlemmar. Gå med i WSM-communityt och tjäna extra genom kryptobörsen.

- TG.Casino saknar svensk licens men är licensierat i Curaçao. Du loggar in via Telegram – snabbt och smidigt. Som ny spelare får du 200 % rakeback upp till 100 € + 50 free spins direkt efter registrering.

- 24Slots är ett pålitligt casino utan Spelpaus som erbjuder ett ”4-i-1 välkomstpaket” upp till 1 000 €, samt en reloadbonus på 50 % upp till 200 € varje vecka.

- Dream.Bet är ett premiumval för slots och sportspel utan Spelpaus. Webbplatsen är tillgänglig i Sverige och erbjuder problemfri registrering och utbetalning. Recensionerna är positiva, inga kända klagomål. Bonusarna för betting är begränsade (t.ex. 100 € vid registrering, upp till 50 € per vecka i reload och månatlig freebet upp till 50 €), men casinodelen har ett mycket bättre utbud.

- Seven Casino är det bästa live casinot utan svensk licens (registrerat i Costa Rica). Låga avgifter, snabba uttag från 20 €, bonus upp till 7 500 € och 10 % cashback. Det är den enda webbplatsen i vår lista med svenskt gränssnitt!

- Rollino avslutar vår topp 10-lista över casinon utan svensk licens. Generösa bonusar – från en startbonus på 450 % upp till 6 000 € på de fyra första insättningarna till veckovis cashback på 5–25 % och ett VIP-program med fem nivåer. Fullt av förmåner, pålitligt casino – vi rekommenderar det starkt!

Jämförelse av populära casinon utan svensk licens

| Casino | Licens | Välkomstbonus | Uttagsgränser | Utbetalningstid | Betyg | Antal spel |

| Instant Casino | Curaçao, nr 8048/JAZ | 200 % upp till €7 500 | från €20 | Omedelbart | 4.8 / 5 | 6 500+ |

| Mega Dice | Curaçao, nr 8048/JAZ | 200 % upp till 1 BTC + 50 free spins | från 0.0001 BTC | Omedelbart | 4.7 / 5 | 6 000+ |

| Lucky Block | Anjouan, nr 2023-001 | 200 % upp till €25 000 + 50 free spins | Inga gränser | Omedelbart | 4.6 / 5 | 4 000+ |

| CashAlot | Curaçao, nr 8048/JAZ | 200 % upp till €500 + 50 free spins | från €20 | Upp till 24 timmar | 4.5 / 5 | 3 000+ |

| WSM Casino | Curaçao, nr 8048/JAZ | 200 % upp till $25 000 + free spins | från €10 | Omedelbart | 4.6 / 5 | 5 000+ |

| TG.Casino | Curaçao, nr 8048/JAZ | 200 % upp till 10 ETH + 50 free spins | från €10 | Omedelbart | 4.7 / 5 | 3 000+ |

| 24Slots | Curaçao, nr 157707 | 100 % upp till €200 | 10× bonusen | Upp till 24 timmar | 4.4 / 5 | 2 000+ |

| Dream.Bet | Curaçao, nr 8048/JAZ | 100 % upp till €100 | från €20 | Upp till 48 timmar | 4.2 / 5 | 2 500+ |

| Seven Casino | Costa Rica, nr CR-2023-001 | 200 % upp till €7 500 + 10 % cashback | från €20 | Upp till 24 timmar | 4.5 / 5 | 3 500+ |

| Rollino | Curaçao, nr 8048/JAZ | 450 % upp till €6 000 + 325 free spins | från €20 | Upp till 24 timmar | 4.6 / 5 | 8 000+ |

Betyg och fördelar hos de bästa online casinon utan svensk licens

| Casino | Tillförlitlighet | Webbplatsens användarvänlighet | Mobilapp | Spelkatalog | Omsättningskrav | Uttagshastighet | Support |

| Instant Casino | ★★★★★ (5.0) | ★★★★★ (5.0) | ★★★★☆ (4.5) | ★★★★★ (5.0) | ★★★★☆ (4.2) | ★★★★★ (5.0) | ★★★★★ (5.0) |

| Mega Dice | ★★★★★ (5.0) | ★★★★★ (5.0) | ★★★★★ (5.0) | ★★★★★ (5.0) | ★★★★☆ (4.3) | ★★★★★ (5.0) | ★★★★☆ (4.8) |

| Lucky Block | ★★★★☆ (4.5) | ★★★★☆ (4.8) | ★★★★☆ (4.7) | ★★★★☆ (4.7) | ★★★★☆ (4.0) | ★★★★☆ (4.9) | ★★★★☆ (4.7) |

| CashAlot | ★★★★☆ (4.5) | ★★★★☆ (4.3) | ★★★★ (4.0) | ★★★★☆ (4.2) | ★★★★☆ (4.4) | ★★★★☆ (4.5) | ★★★★☆ (4.5) |

| WSM Casino | ★★★★☆ (4.7) | ★★★★☆ (4.5) | ★★★★☆ (4.8) | ★★★★☆ (4.8) | ★★★★☆ (4.1) | ★★★★☆ (4.7) | ★★★★☆ (4.7) |

| TG.Casino | ★★★★☆ (4.6) | ★★★★☆ (4.6) | ★★★★★ (5.0) | ★★★★☆ (4.5) | ★★★★☆ (4.2) | ★★★★★ (5.0) | ★★★★☆ (4.8) |

| 24Slots | ★★★★☆ (4.4) | ★★★★ (4.2) | ★★★★ (4.2) | ★★★★ (4.1) | ★★★★☆ (4.0) | ★★★★ (4.2) | ★★★★☆ (4.3) |

| Dream.Bet | ★★★★☆ (4.3) | ★★★★☆ (4.3) | ★★★★☆ (4.3) | ★★★★☆ (4.3) | ★★★★☆ (4.0) | ★★★★☆ (4.3) | ★★★★☆ (4.4) |

| Seven Casino | ★★★★☆ (4.5) | ★★★★☆ (4.4) | ★★★★☆ (4.5) | ★★★★☆ (4.4) | ★★★★☆ (4.1) | ★★★★☆ (4.5) | ★★★★☆ (4.5) |

| Rollino | ★★★★☆ (4.6) | ★★★★☆ (4.5) | ★★★★☆ (4.5) | ★★★★★ (5.0) | ★★★★☆ (4.2) | ★★★★☆ (4.6) | ★★★★☆ (4.7) |

Hur väljer man ett pålitligt online casino utan Spelpaus?

Nu ska vi gå igenom hur vi har sammanställt vår ranking av bästa casinon utan Spelpaus och vilka kriterier du bör fokusera på när du väljer ett casino utan svensk licens. Det är avgörande att du kontrollerar varje punkt innan du börjar spela – det handlar om både säkerhet och spelupplevelse. Kriterierna är relativt enkla, men alla är lika viktiga:

Licens och juridisk transparens

Se till att casinot har en internationell spellicens – exempelvis från Curaçao, Anjouan eller andra erkända myndigheter. Licensen ska vara giltig och lätt att verifiera via den officiella webbplatsen. Casinon med anonym eller undangömd information innebär risker – vi undviker dem och rekommenderar att du gör detsamma.

Registreringsmetoder och enkel inloggning

Kontrollera om webbplatsen är tillgänglig i Sverige och hur den hanterar registrering. Eftersom casinon utan svensk licens inte använder BankID är det viktigt att veta hur du verifierar ditt konto och vilka dokument som krävs. Det påverkar både hur snabbt du får ut pengar och hur du kan ta del av bonusar.

Spelutbud och mjukvara från välkända leverantörer

Ett pålitligt casino online utan svensk licens bör erbjuda spel från leverantörer som NetEnt, Pragmatic Play, Evolution med flera. Då får du rättvist spel och högkvalitativ grafik. Leta efter live casino, krypto slots, Crash-spel, Instant Games och betting – om det är något du gillar.

Bonusvillkor och omsättningskrav

Läs alltid bonusvillkoren noggrant – kontrollera omsättningskrav, insatsbegränsningar och giltighetstid. Ett seriöst casino utan Spelpaus presenterar allt detta öppet. Akta dig för erbjudanden med oändlig cashback eller dolda regler – snygga banners betyder inget om villkoren är oklara.

Uttagshastighet och gränser

Ett bra casino utan licens i Sverige behandlar uttag inom 24 timmar. I vissa fall kan det ta upp till 72 timmar – oroa dig inte, det är normalt. Kontrollera minimi- och maxgränser för uttag, särskilt om du spelar med krypto. Möjlighet till uttag via USDT, BTC, Visa/Mastercard och e-plånböcker är ett stort plus. Tänk på att Swish och Trustly oftast inte är tillgängliga – hitta alternativ som passar dig.

Gränssnitt och support på svenska eller engelska

Spelupplevelsen ska vara smidig. Hitta ett casino utan svensk licens med bra navigering, tydlig layout och kundtjänst på engelska – gärna även svenska.

Recensioner och rykte bland spelare

Läs vad andra spelare tycker – forum, oberoende sajter och recensioner är bra källor. Ett pålitligt casino har dokumenterad utbetalningshistorik, spelarstöd och är ofta med i topplistor hos proffs. Undvik nya varumärken utan feedback och med oklara bakgrunder.

Fördelar och nackdelar med casinon utan licens i Sverige

Det är troligen redan tydligt för våra läsare att det kan vara både lönsamt och säkert att spela på ett casino utan svensk licens och utan Spelpaus – förutsatt att du väljer en pålitlig spelsajt. Samtidigt finns det vissa nackdelar som du absolut bör känna till, eftersom skillnaderna trots allt är ganska betydande.

- Ingen Spelpaus-begränsning. Du kan spela fritt utan automatiska avstängningar eller avbrott. Ansvaret ligger hos dig som spelare – du sätter själv gränser och bestämmer hur länge du vill spela.

- Generösa bonusar och kampanjer. Ett casino utan licens i Sverige omfattas inte av nationella begränsningar och kan erbjuda större välkomstbonusar, cashback, free spins och VIP-program. Du får mer – men kom ihåg att alltid läsa villkoren. Det finns inga gratispengar utan krav!

- Tillgång till kryptobetalningar. Omedelbara insättningar och uttag via Bitcoin, USDT, Ethereum utan avgifter inom några minuter. Många casinon stöder även betalning via PayPal, Paysafecard och andra e-plånböcker.

- Färre insats- och insättningsgränser. Det finns inga veckovisa tak som i svenska casinon – du bestämmer själv hur mycket du vill spela för.

- Globalt spelutbud. Du får tillgång till tusentals slots och live-spel från världsledande leverantörer som inte finns i Spelinspektionens licensierade casinon.

- Smidiga mobilappar. Ladda ner apparna och spela direkt från din mobil eller surfplatta.

- Ingen tillsyn från svenska myndigheter. Om det uppstår en tvist kan du inte vända dig till Spelinspektionen för hjälp eller vägledning.

- Inget BankID-stöd. Registreringen sker manuellt utan digital identitet, vilket innebär att verifieringen kan vara lite mer omständig och ta längre tid.

- Vissa sajter accepterar inte svenska spelare. Läs alltid reglerna innan du skapar ett konto. Alla casinon i vår topplista accepterar dock svenska spelare utan begränsningar.

- Ingen automatisk spelpaus. Eftersom Spelpaus inte gäller måste du själv ta ansvar för ditt spelbeteende. Många sajter erbjuder länkar till organisationer som arbetar mot spelberoende – använd dem vid behov.

- Ökad risk för bedrägerier. Det är viktigt att du kontrollerar licensen och casinots rykte innan du registrerar dig och börjar spela.

Hur registrerar man sig på ett online casino utan svensk licens?

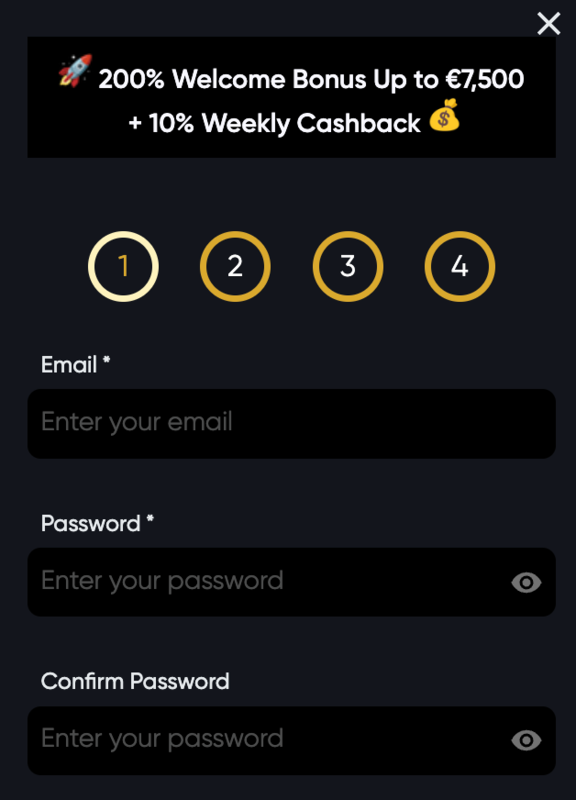

I casinon utan svensk spellicens används inte BankID för inloggning, men du kan ändå snabbt skapa ett konto. Registrering är möjlig via e-post, mobilnummer, Telegram eller genom att koppla en kryptoplånbok – något som blivit standard på många populära sajter. Låt oss gå igenom hur det fungerar steg för steg med exempel från krypto casinot Mega Dice – ett av de mest välkända varumärkena 2026.

Steg 1: Öppna registreringssidan på casinots webbplats

Gå till Mega Dices officiella hemsida (eller ett annat casino utan licens som du har valt). På höger sida av skärmen ser du ett formulär med rubriken ”Registrera dig”. Här kan du välja registreringsmetod: klassisk (e-post), via Telegram eller med kryptoplånbok.

Steg 2: Fyll i formuläret

Om du väljer standardregistrering anger du din e-postadress, väljer ett användarnamn och skapar ett starkt lösenord (som du bekräftar). Du väljer kontovaluta, anger eventuell kampanjkod och väljer välkomstbonus. Kryssa i att du är över 18 år och klicka på ”Registrera dig”. Alla uppgifter måste vara korrekta – det kontrolleras!

Steg 3: Bekräfta kontot och gör en insättning

Efter registreringen loggas du automatiskt in och kommer till sidan ”Mitt konto”. Vi rekommenderar att du direkt fyller i personuppgifter – fullständigt namn, adress, telefonnummer, kön och födelsedatum. Dessa behövs vid verifiering. Gå sedan till ”Plånbok”-fliken, ange belopp och gör din första insättning. I casinon utan svensk licens genomförs insättningar omedelbart och saldot uppdateras direkt.

Steg 4: Verifiera din identitet

Även om BankID inte används kräver Mega Dice verifiering vid större uttag. Du ska ladda upp en bild på pass eller ID, en selfie med dokumentet samt adressbevis (t.ex. elräkning eller bankutdrag). Vid behov kan säkerhetsteamet också begära verifikation av betalmetod – lämna in dessa uppgifter, det är tryggt.

Därmed är du redo att börja spela och ta ut dina vinster i riktiga pengar. Inga spelpauser eller tvångsavbrott – på ett casino utan spelpaus bestämmer du själv!

Det finns även en särskild typ av casino utan registrering – så kallade Pay n Play-casinon. Att spela utan konto är praktiskt, anonymt och lagligt, men kan vara mindre smidigt. Om du stänger din session kan du inte återuppta den senare – casinon utan konto är i praktiken engångsalternativ. Det är ändå ett intressant koncept.

Uttag av vinster från casinon utan svensk licens

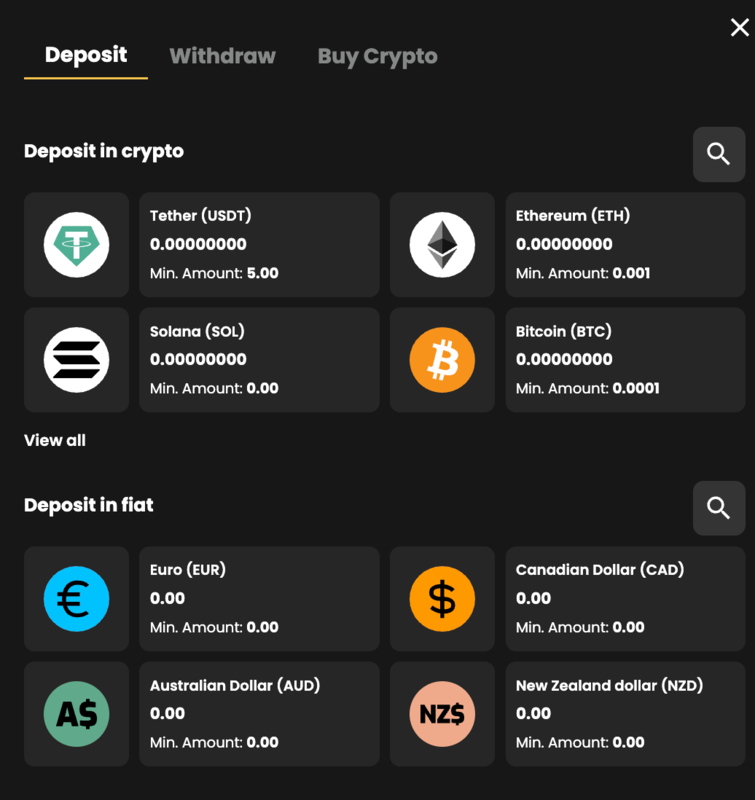

Casinon utan licens i Sverige gör det möjligt att ta ut pengar snabbt, anonymt och utan BankID. Det är särskilt smidigt att använda kryptovalutor – här visar vi hur processen går till hos Mega Dice.

Steg 1: Gå till ”Kassa” – Uttag

När du är inloggad, öppna menyn ”Plånbok” och välj fliken ”Uttag”. Gränssnittet är intuitivt – du ser direkt ett formulär där du väljer valuta, nätverk och adress. Välj metod direkt.

Steg 2: Välj kryptovaluta och blockkedjenätverk

Mega Dice erbjuder uttag via USDT, Bitcoin, Ethereum och andra valutor. Välj den du föredrar (t.ex. USDT) och därefter det nätverk som passar dig – Ethereum (ERC20) eller BSC (BEP20). Andra casinon utan svensk licens erbjuder andra betalmetoder, men det är inte avgörande – välj det som är mest bekvämt för dig. Nätverket påverkar både avgift och hastighet.

Steg 3: Ange din kryptoplånboksadress

Kopiera och klistra in den exakta adressen till din plånbok (t.ex. MetaMask eller Trust Wallet). Använd aldrig adresser som tillhör tredje part – casinot tar inget ansvar för felaktiga överföringar. Samma gäller kort och e-plånbokstransaktioner.

Steg 4: Ange uttagsbelopp

Minsta belopp beror på vald valuta. Vanligtvis börjar uttagen från €20 och går upp till €20 000 per transaktion. Du kan ange vilket belopp du vill som finns tillgängligt på ditt saldo, minus ej omsatta bonusar. Reglerna för omsättningskrav förklaras längre ner i avsnittet ”Bonusar och kampanjer”.

Steg 5: Bekräfta uttaget och vänta på transaktionen

Klicka på ”Ta ut pengar” – begäran skickas för behandling. Vanligtvis tar uttag mellan några minuter och upp till en timme beroende på nätverkets belastning. Observera att eventuella bonusar försvinner vid uttag – det är en standardregel i de flesta casinon utan spelpaus. Du får en bekräftelse så snart pengarna är överförda, och statusen visas i ditt konto.

Vad är ett casino utan svensk licens och Spelpaus?

Ett casino utan svensk licens är ett online casino som inte regleras av Spelinspektionen. Sådana plattformar har internationella licenser (t.ex. från Curaçao eller Malta) och accepterar spelare från Sverige utan krav på BankID. Det finns inga insättningsgränser och ingen obligatorisk Spelpaus – det är praktiskt.

Till skillnad från svenska operatörer erbjuder casinon utan licens i Sverige högre bonusar, daglig cashback, tusentals spel och stöd för kryptovalutor vid uttag. Spelare kan registrera sig anonymt, välja valfri valuta och ta ut vinster inom några timmar. Det viktigaste är att kontrollera licens och rykte innan registrering.

När du spelar på ett casino utan svensk licens tar du fullt ansvar för ditt spelbeteende. Trots avsaknaden av svensk tillsyn har de flesta internationella casinon giltiga licenser, skydd av personuppgifter och verktyg för självbegränsning. Ett seriöst casino utan svensk spellicens publicerar bonusvillkor öppet, främjar ansvarsfullt spelande och garanterar rättvisa utbetalningar.

Så regleras utländska casinon och frånvaron av Spelpaus

Online-spel regleras nationellt, och i Sverige ansvarar Spelinspektionen. Varje casino som vill vara aktivt på den svenska marknaden måste ha licens och följa regler som Spelpaus och insättningsgränser. Det är därför allt fler spelare väljer alternativ – casinon utan svensk licens som fungerar enligt internationella regler och accepterar svenska spelare utan restriktioner. Enligt öppen statistik för 2023–2024 valde över 67 % av spelarna sådana plattformar.

Är det tillåtet att spela på ett casino utan svensk licens?

Ja, som privatperson bryter du inte mot lagen om du spelar på en plattform utan licens i Sverige. Spelare har rätt att själva välja internationella casinon, förutsatt att de accepterar användare från Sverige. Det är dock viktigt att förstå att dessa casinon inte lyder under svensk lag och inte omfattas av Spelinspektionens krav.

Hur känner man igen ett oseriöst eller olagligt casino?

Olicensierade sajter utan någon form av tillstånd, med anonyma ägare, utan kontaktuppgifter eller användarvillkor är riskabla. Särskilt misstänkta är casinon som erbjuder orimliga bonusar (t.ex. 1000 % i insättning) och saknar kundsupport. Casinon utan licens i Sverige är inte automatiskt olagliga – men om de inte regleras alls är det en varningssignal.

Internationella casinon lyder inte under svenska regler

Casinon utan licens från Spelinspektionen har ingen skyldighet att tillämpa Spelpaus, införa insättningsgränser eller begränsa åtkomst till spel. Spelare på sådana casinon omfattas inte av skyddet som svenska lagar erbjuder, inklusive Spellagen från 2019.

Samtidigt regleras de flesta större casinon utan svensk licens av internationella jurisdiktioner som Curaçao, Malta eller Anjouan. Det ger ett grundläggande skydd, transparenta utbetalningar och ett licensvillkorat ansvar från operatören. Dessa tillsynsmyndigheter hanterar spelarärenden och kan återkalla licenser vid allvarliga brott.

Begränsade rättigheter vid tvister eller bedrägerier

Om du får problem med uttag eller oegentligheter från operatören kan du inte kontakta svenska myndigheter som Konsumentverket eller Spelinspektionen. All kommunikation sker med utländsk support – ofta utan garanti för återbetalning.

Därför är det avgörande att du väljer ett licensierat internationellt casino – med tydlig licensinformation, öppen policy och supportfunktion. Ett seriöst casino utan svensk licens visar alltid sin jurisdiktion (t.ex. Curaçao eGaming) och har klara rutiner för klagomål. Casinon i vår ranking är säkra, blockerar aldrig utan skäl och svarar alltid på spelarens begäran.

Betalningar och valutor: vad kan du förvänta dig?

Casinon utan svensk licens erbjuder fler betalningsmetoder än svenska operatörer. Det inkluderar kryptovalutor (USDT, BTC, ETH), e-plånböcker (Skrill, Neteller) och till och med P2P-betalningar. BankID och Swish är vanligtvis inte tillgängliga.

Sådana casinon accepterar olika valutor – euro, dollar, krypto – vilket gör att du slipper SEK-konverteringar.

Alternativ till BankID i casinon utan svensk registrering

Till skillnad från svenska sajter använder internationella casinon förenklad registrering. Du kan skapa konto med e-post och lösenord, eller logga in direkt via sociala medier (vissa uppgifter fylls i automatiskt – det bör anges på sidan). BankID används inte. Vid stora uttag kan du dock behöva verifiera identitet – ladda upp ID-handling och adressbevis. Det är standard på alla licensierade casinon och helt säkert.

Vad är skillnaden mellan casinon med och utan svensk licens?

Låt oss kort gå igenom vad som skiljer ett casino utan svensk licens från operatörer med licens från Spelinspektionen.

| Parameter | Casino med svensk licens | Casino utan svensk licens |

| Licens och tillsynsmyndighet | Spelinspektionen, strikt reglerad | Curaçao, Anjouan, Malta, Costa Rica m.fl. |

| Registrering med BankID | Obligatoriskt för att skapa konto | Registrering via e-post eller mobilnummer |

| Spelpaus-begränsningar | Tillgång blockeras vid aktiverad paus | Ingen Spelpaus, spel utan begränsningar. Stöd för Gamblock, Betblocker och Gamban |

| Insättningsgränser | Hårda veckogränser (t.ex. 5 000 SEK) | Upp till €40 000 per månad är vanligt |

| Bonusar och cashback | Mycket begränsade, inga välkomstbonusar | Stora bonusbelopp, free spins, cashback, kampanjkoder, VIP-bonusar |

| Spelutbud och leverantörer | Cirka 1 000 slots, poker och sportspel | Upp till 50+ leverantörer och 5 000+ spel i katalogen |

| Betalningsmetoder | Swish, Trustly | BTC, ETH, USDT, e-plånböcker, kortutbetalningar, banköverföringar |

| Utbetalningstid | Vanligen 1–3 arbetsdagar | I genomsnitt 6–12 timmar |

Skatter på vinster från casinon utan svensk licens

När du spelar på ett casino utan svensk licens är det viktigt att förstå att dina skyldigheter gentemot Skatteverket inte försvinner, även om plattformen är registrerad utomlands. Beskattning beror på var casinot är registrerat och hur mycket du vinner. Vissa vinster är helt skattefria, i andra fall måste du betala upp till 30 % i skatt på vinsten.

Skatter vid spel på casinon med EU-licens

Om casinot är registrerat inom Europeiska ekonomiska samarbetsområdet (EES) och inte bryter mot svensk lag, är vinsterna skattefria. Det gäller t.ex. casinon med licens från Malta eller Estland. Dessa plattformar betraktas som ”lagliga inom EU” även om de inte har tillstånd från Spelinspektionen.

Huvudvillkoret är att casinot inte får vara förbjudet i Sverige och spelet får inte bryta mot nationella regler. I sådana fall får du behålla hela vinsten utan skattskyldighet.

Casinon utanför EU: 30 % skatt på vinster

Om du spelar på casinon registrerade utanför EES – t.ex. i Curaçao, Costa Rica eller på ön Anjouan – betraktas vinsten som ”utländsk inkomst” och är skattepliktig. Skattesatsen är 30 % av nettovinsten.

Regeln gäller när du gör uttag som överstiger 100 SEK, oavsett om det är i krypto eller traditionell valuta. Skatt utgår när vinsten realiseras, t.ex. när krypton omvandlas till SEK eller EUR.

Hur beräknas den beskattningsbara vinsten?

Skatt betalas inte på hela uttagsbeloppet, utan på nettovinsten – alltså skillnaden mellan insatta och uttagna pengar. Exempel:

- Du sätter in 2 000 SEK och tar ut 4 000 SEK

- Nettovinst: 2 000 SEK

- Skatt: 30 % på 2 000 = 600 SEK.

Du är själv skyldig att redovisa denna vinst till Skatteverket som utlandsinkomst. I praktiken rapporterar många spelare inte detta, och det får sällan konsekvenser – så länge Skatteverket inte får reda på ursprunget.

Kommer myndigheterna se att jag tagit ut pengar från ett casino?

Erfarenhet och tillgänglig statistik visar att det vanligtvis inte upptäcks. Men om du använder banköverföring eller betalsystem som Trustly, Revolut, Wise eller bankkort, kan transaktionen registreras. Svenska banker måste rapportera misstänkta eller regelbundna insättningar från utlandet – särskilt stora belopp väcker uppmärksamhet.

Vid användning av kryptovalutor är risken lägre. Men Skatteverket arbetar aktivt för att spåra odeklarerade vinster, särskilt om du växlar tillbaka till SEK via KYC-verifierade börser eller plånböcker.

Dina uppgifter och transaktioner är säkra hos pålitliga casinon utan svensk licens. Inga tredje parter får information om din spelaktivitet. Det garanteras av casinots integritetspolicy.

| Typ av casino | Registrering | Skatteplikt? | Skattesats |

| Casino med svensk licens | Sverige | Nej | — |

| Casino inom EU utan svensk licens | Malta, Estland m.fl. | Nej | — |

| Casino utanför EU | Curaçao, Costa Rica m.fl. | Ja | 30 % |

| Kryptocasino | Alla länder | Ja, vid vinst | 30 % |

Hur fungerar casinon utan Spelpaus i Sverige?

Spelpaus är ett nationellt självavstängningssystem som utvecklats av Spelinspektionen för att bekämpa spelberoende. När en spelare aktiverar Spelpaus blockeras denne automatiskt från alla licensierade casinon, spelbolag och fysiska spelhallar i Sverige. Däremot gäller inte Spelpaus hos casinon utan svensk licens, vilket innebär att du kan fortsätta spela även under aktiv avstängning.

Hur fungerar Spelpaus och vem omfattas?

Webbplatsen Spelpaus.se låter dig tillfälligt eller permanent stänga av dig från alla licensierade spel i Sverige. Avstängningen aktiveras via BankID och gäller omedelbart för alla svenska online casinon med licens, sportspel, fysiska spelautomater, statliga lotterier och bingo.

Casinon utan licens i Sverige – t.ex. de som är registrerade i Curaçao, Malta eller Anjouan – är inte kopplade till Spelpaus och kontrollerar inte om du är blockerad. De låter dig skapa konto och spela oavsett din status i systemet.

Kan jag blockera mig själv manuellt hos ett casino utan Spelpaus?

Ja, de flesta pålitliga casinon utan svensk licens erbjuder interna verktyg för självavstängning. Du kan sätta insättningsgränser eller förlustgränser, pausa ditt konto i 24 timmar, 7 dagar, 1 månad eller radera det permanent. Det räcker att kontakta supporten för att begära total avstängning.

Nackdelen är att detta inte är centralt – om du stänger av dig från ett casino kan du fortfarande spela på andra.

Har du märkt tecken på spelproblem? Kontakta internationella organisationer som erbjuder anonym hjälp (se relevanta länkar längre ner i artikeln).

Avstängningsperioder och om det går att avbryta i förtid

Följande avstängningsperioder finns på Spelpaus:

- 1 månad

- 3 månader

- 6 månader

- Tills vidare (obegränsad).

Du kan inte häva avstängningen i förtid. Även om du ångrar dig förblir systemet aktivt tills perioden löpt ut. Det är ett skydd för spelaren för att förhindra impulsiva återfall i spel.

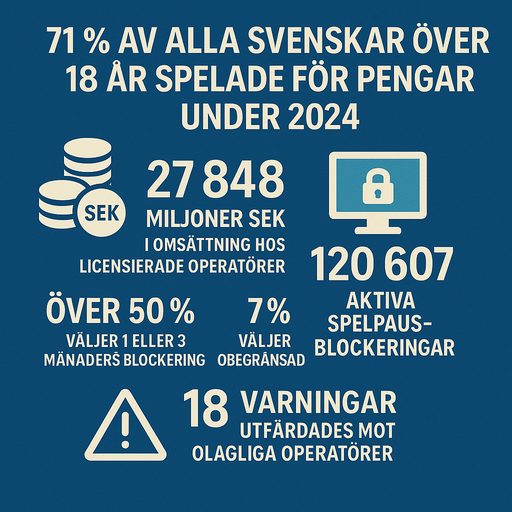

Statistik om Spelpaus i Sverige

Enligt Årsrapport Spelinspektionen 2024 hade över 110 000 personer i Sverige aktiverat Spelpaus vid början av 2026. Nästan 40 % valde obegränsad avstängning. Det visar stor medvetenhet kring spelberoende och behovet av skyddsmekanismer. Mer än 77 % av de blockerade är män.

Mer siffror från rapporten:

- 71 % av alla svenskar över 18 år spelade för pengar under 2024

- 27 848 miljoner SEK i omsättning hos licensierade operatörer

- 616 aktiva spellicenser

- 120 607 aktiva Spelpaus-blockeringar

- Över 50 % väljer 1 eller 3 månaders blockering

- Endast 7 % väljer obegränsad blockering

- 18 varningar utfärdades mot olagliga operatörer.

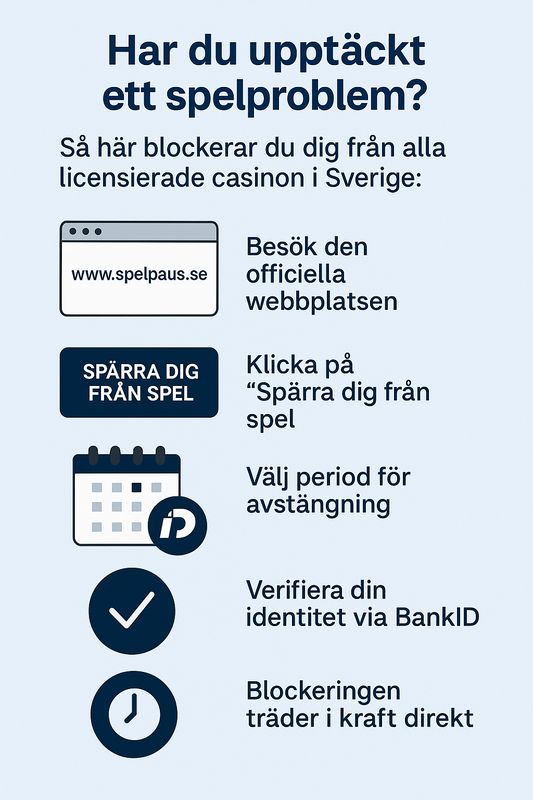

Så aktiverar du spelpaus: steg-för-steg

Har du upptäckt ett spelproblem? Så här blockerar du dig från alla licensierade casinon i Sverige:

- Besök den officiella webbplatsen: Gå till www.spelpaus.se – det är Spelinspektionens portal.

- Klicka på “Spärra dig från spel”: Knappen finns direkt på startsidan.

- Välj period för avstängning: 1 månad, 3 månader, 6 månader eller tills vidare.

- Verifiera din identitet via BankID: Krävs för att aktivera blockeringen och skydda din information.

- Blockeringen träder i kraft direkt: Du blir omedelbart blockerad från alla svenska licensierade operatörer.

Viktigt: Det går inte att avbryta eller korta ner perioden. Även om du vill återvända, måste du vänta tills den valda perioden är över.

Ansvarsfullt spelande hos casinon utan Spelpaus

Casinon utan Spelpaus är inte anslutna till det svenska självavstängningssystemet, men de ignorerar inte principerna för ansvarsfullt spelande. De flesta licensierade operatörer utan svensk licens har egna verktyg för att skydda spelare mot skadligt spelbeteende. Tillgången till dessa funktioner beror på casinots licens, plattformens seriositet och de inställningar som finns i spelarkontot.

Det finns många kontrollverktyg: insättningsgränser, sessions-timers och tillfälliga avstängningar. Här går vi igenom dem mer i detalj.

Organisationer som hjälper mot spelberoende

Om du känner att ditt spelande håller på att gå överstyr – sök hjälp. Här är beprövade resurser:

- Stödlinjen – svensk stödlinje med anonym chatt och telefonrådgivning, öppen dygnet runt.

- GamCare – internationell organisation för spelberoendeförebyggande arbete, tillgänglig på engelska.

- BeGambleAware – informationsportal med självtest, tips och direktkontakt med rådgivare för både spelare och anhöriga.

Så ställer du in spelgränser hos casinon utan svensk licens

De flesta seriösa utländska casinon erbjuder manuella inställningar för begränsning av spelbeteende. Vanligtvis finns följande funktioner:

- Insättningsgräns – ange maxbelopp per dag, vecka eller månad (t.ex. €50/vecka).

- Förlustgräns – begränsa summan du kan förlora under en viss period.

- Spelsessionstimer – automatiskt utloggning efter fördefinierad speltid.

- Tillfällig kontoblockering – från 24 timmar till 6 månader.

- Permanent självavstängning – kontot raderas utan återställningsmöjlighet.

- Avstängning från bonusar – ta bort kampanjer och bonusannonser.

Alla dessa funktioner finns i kontoinställningarna eller via kundtjänst under rubriken “Responsible Gambling”.

Så stänger du av dig från casinot?

Exempel på hur du blockerar dig själv hos ett av de bästa casinona utan svensk licens, Instant Casino:

- Logga in i ditt spelkonto

- Gå till avsnittet Responsible Gaming

- Välj alternativet Self-Exclusion

- Välj en period: från 24 timmar till obegränsad blockering

- Bekräfta – kontot låses omedelbart.

Du kan även kontakta supportchatten och be om manuell blockering – operatören stänger då kontot på några minuter.

Finns det verktyg för att blockera all tillgång till spelsajter?

Ja, det finns effektiva verktyg som gör det omöjligt att besöka casinon eller spelsidor på nätet:

GamBlock

GamBlock – ett professionellt program som blockerar alla kända spelsajter och uppdateras regelbundet. Det fungerar på Windows, Android och andra system.

Programmet installeras som ett systemverktyg och skyddas med lösenord, så att användaren inte kan ta bort det utan administratörsrättigheter. Det är särskilt användbart för den som vill sluta spela långsiktigt eller hjälpa en närstående.

BetBlocker

BetBlocker – ett kostnadsfritt program som begränsar tillgången till mer än 15 000 sajter relaterade till spel om pengar. Användaren väljer själv hur lång blockeringen ska vara, från 24 timmar till livstid.

Programmet finns för alla stora operativsystem, inklusive mobilplattformar. Det går också att aktivera ett särskilt läge för föräldrakontroll, vilket gör det möjligt att begränsa andra användares åtkomst till spel på samma enhet.

Net Nanny

Net Nanny är ett välkänt verktyg för föräldrakontroll som kan konfigureras för att blockera specifika webbplatskategorier – inklusive spel om pengar, vadslagning och onlinecasinon. Programmet fungerar i realtid och filtrerar allt webbinnehåll.

Efter installationen kan du själv välja vilka kategorier som ska blockeras. Gränssnittet är användarvänligt och ger detaljerade rapporter om besökta sidor. Det passar både för familjer och för användare som vill kontrollera flera enheter samtidigt. Net Nanny förhindrar dessutom försök att kringgå blockeringen via VPN eller dolda domäner. Väldigt smidigt – användaromdömena är mycket positiva.

Hur känner man igen spelberoende?

Spelberoende kan utvecklas gradvis – särskilt i online casinon utan Spelpaus. Viktigt att uppmärksamma följande varningstecken:

- Du spelar längre eller oftare än du planerat

- Du förlorar kontroll över insatser

- Du döljer spelande eller ljuger om pengar

- Du försöker vinna tillbaka förluster

- Du känner ångest, skuld eller irritation efter spel

- Du tänker ständigt på spel och casinon

- Du prioriterar spel framför sömn, jobb eller relationer.

Om du känner igen dig i minst 2–3 av dessa punkter – ta det på allvar. Det kan vara tidiga tecken på beroende.

Vill du testa dig själv? Gå in på Stodlinjen.se och besvara 9 frågor anonymt. Oroar du dig för beroende? Ring Stödlinjen: 020-81 91 00 – en kostnadsfri tjänst i samarbete med Folkhälsomyndigheten.

Bonusar och kampanjer hos casinon utan svensk licens

Bonusar hos casinon utan svensk licens skiljer sig tydligt från traditionella svenska erbjudanden – inte bara i storlek, utan även i variation. Orsaken är enkel: internationella casinon följer inte Spelinspektionens hårda restriktioner och kan därför erbjuda ett komplett bonussystem – från cashback till exklusiva turneringar.

I Sverige får casinon enligt kapitel 9, paragraf 14 i Spellagen (2018:1138) endast erbjuda bonus en gång – vid första registrering. Alla upprepade kampanjer, lojalitetsbonusar eller cashback betraktas som otillåten marknadsföring.

Välkomstbonusar

Hos casinon utan svensk licens får du en välkomstbonus redan vid första insättningen. Ofta handlar det om 100 % eller mer – ibland fördelat över flera insättningar som ett "välkomstpaket" – samt gratissnurr på populära slots. Bonusen läggs på ett separat bonussaldo och kräver omsättning innan uttag. Använd bonusen direkt efter registreringen och håll utkik efter registreringskoder – de ökar bonusen eller ger extra fördelar.

Reload-bonusar

Reload-bonusar är tillgängliga för redan registrerade spelare. Dessa erbjuds vissa dagar i veckan eller via personliga kampanjer, till exempel 50–100 % på nästa insättning, tidsbegränsade erbjudanden med lägsta gräns från €10. Reload-bonusar har låga omsättningskrav – särskilt vid kampanjer kopplade till högtider.

Gratissnurr

Förutom bonuspengar erbjuder de bästa casinona utan svensk licens även gratissnurr. Vanligt antal är 10–250 snurr på populära slots som Book of Dead eller Sweet Bonanza. Vinster från snurren placeras på bonussaldot och omfattas av omsättningskrav om inget annat anges. Läs alltid villkoren.

Cashback och rakeback

Cashback innebär att du får tillbaka en del av dina förluster. Internationella casinon erbjuder daglig, veckovis eller VIP-cashback – mellan 5 % och 25 %, ibland utan omsättningskrav (men sällsynt). Rakeback är vanligare i poker och ger tillbaka en procentandel av spelade händer. Exempel: hos Instant Casino får du 10 % varje måndag – helt utan omsättningskrav, och uttag är direkt tillgängliga.

Bonus utan insättning

Vissa casinon online erbjuder en bonus utan insättning – exempelvis €10 eller 50 gratissnurr. Sådana bonusar är sällsynta, men finns. Enkla sätt att få dem är att använda kampanjkod eller aktivera personlig kampanj. Ett konkret exempel: Golden Panda ger en födelsedagsbonus utan insättning.

Tips: Prenumerera på marknadsutskick från casinot – där får du unika erbjudanden utan krav på insättning eller omsättning.

Lojalitetsprogram och kampanjer

Casinon utan svensk licens har ofta nivåbaserade VIP-system. Ju mer du spelar, desto högre blir återbäring, personliga bonusar, tillgång till kampanjer och kontakt med din egen VIP-manager. Du samlar automatiskt lojalitetspoäng efter registrering – fler insatser och uppdrag leder till snabbare nivåhöjning och bättre privilegier.

Exempel: hos Lucky Block består lojalitetsprogrammet av 11 nivåer – från Rookie till Legend. På högsta nivån får du 0,40 % rakeback, unika kampanjkoder, högre uttagsgränser utan väntetid och exklusiva förmåner.

Turneringar

Turneringar är till för de mest aktiva spelarna. Du samlar kvalificeringspoäng genom att spela utvalda spel. Prispotten delas mellan de bästa deltagarna. De främsta onlinecasinona utan svensk licens erbjuder regelbundna slot- och live-turneringar med prispotter från €1 000 till över €100 000. Deltagandet är gratis, men du måste spela för ett visst belopp för att kvalificera dig.

Turneringar är tidsbegränsade – håll koll på kommande event.

Topp 5 casinon utan svensk licens – bonusar och kampanjer jämförda

| Casino | Välkomstbonus | Omsättningskrav | Övriga kampanjer | No Deposit | Kampanjkoder |

| Instant Casino | 200 % upp till €7 500 + gratissnurr | x35 bonus, x30 snurr | 10 % cashback, VIP-program | ✅ | ✅ |

| Golden Panda | 450 % upp till €6 000 (4 insättningar) + 50 FS | x40 på alla bonusmedel | 5–25 % cashback, VIP-nivåer | ✅ | ✅ |

| 24Slots | €1 000-paket + 50 % veckovis | x10 sportbonus, x40 casino | Reloadbonusar varje vecka upp till €200 | ❌ | ✅ |

| Mega Dice | 200 % upp till 1 BTC + 50 gratissnurr | x40 bonus, x30 snurr | 15 % veckovis cashback, lördagsslots, söndags-live-turneringar | ❌ | ✅ |

| Lucky Block | 200 % upp till €25 000 + 50 gratissnurr | x35 bonus, x30 snurr | Krypto-cashback, turneringar, kampanjspel | ✅ | ✅ |

Bonusvillkor: är det värt att använda kampanjer?

Bonusar hos internationella casinon utan svensk licens är utan tvekan mer varierade, men varje bonus har tydliga regler som måste läsas noggrant innan du aktiverar något. Spelare som glömmer att nästan alla bonusar är kopplade till specifika villkor riskerar att få sina vinster ogiltigförklarade – vilket ofta leder till negativa recensioner och klagomål. I det avseendet är svenska casinon stabilare, men mindre intressanta.

Här är de 6 viktigaste villkoren att känna till:

- Omsättningskrav: Det viktigaste är hur många gånger bonusbeloppet måste omsättas innan det kan tas ut. Vanligtvis är det x30–x45. Ju lägre krav, desto bättre.

- Giltighetstid: Bonusar gäller oftast mellan 3 och 30 dagar. Om du inte omsätter i tid förloras både bonusen och eventuella vinster.

- Insatsgräns: Under omsättning får du inte satsa mer än det angivna maxbeloppet (t.ex. €5 eller €10). Överskridande leder till att bonusen blir ogiltig.

- Tillåtna spel: Inte alla spel räknas mot omsättningskravet. Oftast gäller bara slots, och även där är vissa undantagna.

- Maxvinst: Casinot sätter ofta ett tak på hur mycket du kan vinna med en bonus. Exempelvis högst €100 från en no deposit-bonus.

- Minsta insättning: Alla bonusar (förutom no deposit) kräver att du gör en insättning över ett visst belopp. Du måste sätta in i tid för att bonusen ska aktiveras.

Kan man kombinera flera bonusar?

Hos casinon utan svensk licens är det möjligt att aktivera flera bonusar och kampanjkoder samtidigt, så länge reglerna inte uttryckligen förbjuder det. Exempelvis kan du delta i en slotturnering och samtidigt få cashback. Däremot kan du inte få två välkomstbonusar på samma konto – som regel gäller bara en bonus vid registrering, oavsett om det är för casino eller sport.

Om du anser att villkoren är ofördelaktiga eller för komplicerade, kan du alltid tacka nej till bonusen och spela med riktiga pengar på ett casino utan svensk licens – utan krav på omsättning eller begränsningar för maxvinst.

Spelutbud hos casinon utan svensk licens

Spelutbudet är ytterligare en stark fördel hos casinon utan svensk licens. Det finns så många spel att varje spelare hittar en genre, speltyp och unika automater som passar just deras smak.

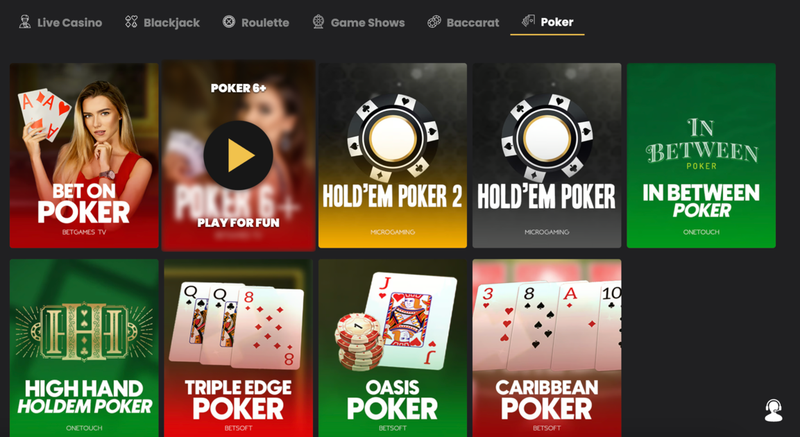

Poker utan svensk licens

Poker utan svensk licens är populärt bland spelare. Det handlar om varierade och lönsamma spel där inte bara tur avgör, utan även erfarenhet och strategi vid bordet. På internationella casinon finns både livepokerbord och videopoker samt stora turneringar med inköp från €1 till €5 000. Frånvaron av Spelpaus innebär att du kan spela när du vill utan avbrott eller verifiering med BankID. Dessutom erbjuder casinon utan svensk licens rakeback och bonusar för pokerspelare.

Texas Hold’em

Den klassiska versionen med två hålkort och fem gemensamma kort. Finns både i livecasino och turneringar hos Mega Dice och Lucky Block.

Omaha

En pokervariant med fyra hålkort och hög speltempo. Finns på kryptocasino med pokersektioner.

Caribbean Stud

Spelas mot dealern och innehåller en progressiv jackpott. Populärt hos Instant Casino och Golden Panda.

Three Card Poker

Snabb version med tre kort där du spelar mot dealerns hand. Finns under Live Casino-avdelningen.

Videopoker

Enspelarläge baserat på slumptalsgenerator – Jacks or Better, Deuces Wild m.fl. Finns på alla casinon i vår topplista.

Bästa bordsspelen hos casinon utan svensk licens

Casinon utan svensk licens erbjuder tiotals varianter av klassiska bordsspel – både mot riktiga dealers och som automatiserade versioner. Här är fem av de mest populära typerna av bordsspel.

Baccarat

Målet är att nå 9 poäng genom att satsa på spelaren, banken eller oavgjort. Finns hos Instant Casino och Mega Dice med minsta insats från €1 (över 15 olika varianter).

Blackjack

Få 21 utan att överstiga dealern – finns i dussintals versioner: klassisk, multi-hand, surrender m.fl. Välj mellan strategi eller risk för att vinna.

Roulette

Europeisk och amerikansk variant, samt Lightning, Auto-Roulette och exklusiva VIP-rouletter. Hos Mega Dice hittar du t.ex. över 30 roulettbord med olika insatsgränser och regler.

Sic Bo

Ett asiatiskt tärningsspel med tre tärningar och många möjliga satsningar. Finns i de bästa kryptocasinona med livedealers, t.ex. Lucky Block.

Craps

En av de enklaste tärningsspelen. Kasta tärningarna och gissa resultatet för dig och motståndaren. Finns i många versioner från välkända leverantörer som Evolution Gaming och Live Solutions.

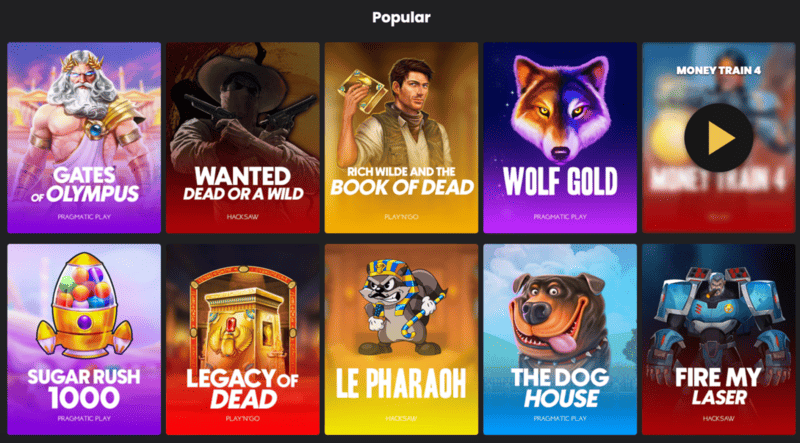

Bästa online slots hos casinon utan svensk licens

Slots är utan tvekan den största och mest varierade spelkategorin hos alla onlinecasinon utan licens i Sverige. Genremångfalden, olika spelformer, inbyggda bonusfunktioner och vinstmöjligheter är de största fördelarna med spelautomater på dessa plattformar.

Klassiska slots med 3–5 hjul

Klassiska spelautomater med minimalistisk design och enkla regler, inspirerade av fysiska casinon. Inga komplicerade funktioner – få vinstlinjer, klassiska fruktsymboler och slumpmässiga vinster är kännetecknande för dessa spel. Samtidigt finns det unika automater med högt RTP. Spel som Sweet Bonanza, Triple 7s och Fruit Zen finns på nästan alla casinon utan Spelpaus.

Megaways-slots

Dessa spel skiljer sig genom att antalet symboler på hjulen förändras vid varje snurr, vilket skapar upp till 117 649 olika vinstvägar. Ett typiskt exempel är Bonanza Megaways från Big Time Gaming, tillgängligt hos Mega Dice och Lucky Block. Vinsterna är större och mer frekventa – men det betyder inte att det är lättare att vinna.

Casinots egna exklusiva spel

De bästa casinona utan svensk licens utvecklar egna slots med unik design, specialfunktioner och bonusar som inte finns någon annanstans. Instant Casino och Golden Panda har exempelvis spel med NFT-element eller dagliga turneringsjackpottar.

Jackpot-slots

Spel med fasta eller progressiva jackpottar där en enda snurr kan ge vinster på tiotusentals euro. De mest kända är Mega Moolah, Divine Fortune och Jackpot Raiders – tillgängliga på de flesta casinon utan svensk licens. Jackpotten aktiveras slumpmässigt – och du kan vinna även vid minsta insats.

Slots med köp av bonus

I dessa spel kan du köpa dig direkt in i bonusläget utan att vänta. Det sparar tid och ger omedelbar tillgång till free spins och multiplikatorer. Exempel: Sweet Bonanza, Money Train 2, Chaos Crew. Priset för bonusköp är ofta högt och lönar sig inte alltid – använd därför din spelbudget klokt.

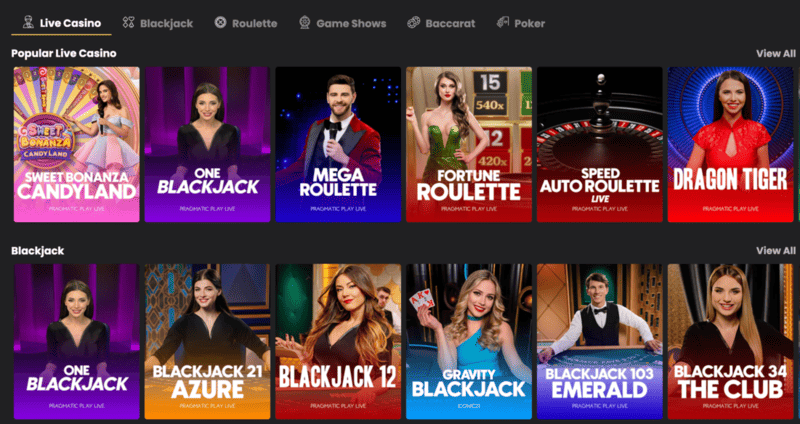

Live dealer-spel hos casinon utan svensk licens

Live dealers finns inte hos svenska onlinecasinon – bara hos de bästa casinona utan svensk licens. PlayOJO har visserligen ett litet liveutbud, men det är begränsat. I livecasino spelar du mot en riktig croupier som delar kort, snurrar roulettehjulet och interagerar med dig i realtid. Du kan även chatta med andra spelare.

Livepoker

De mest populära varianterna med dealer är Casino Hold’em, Three Card Poker och Caribbean Stud. Du spelar mot dealern, inte mot andra spelare. Hos Golden Panda hittar du t.ex. Live Poker Ruby och andra bord med olika insatsnivåer.

Liveroulette

Klassisk roulette med snurrande hjul, professionell dealer och fullbordat spelbord. Både europeisk och amerikansk roulette erbjuds, samt showvarianter som Lightning Roulette och Speed Roulette. Hos Golden Panda finns över 35 typer, inklusive Roulette 10 och PowerUP Roulette.

Live baccarat

En av de enklaste spelen: satsa på spelaren, banken eller oavgjort – vinnaren är den hand som kommer närmast 9. Casinon utan svensk licens har dussintals livebord med baccarat, t.ex. Speed Baccarat 10 och Private Lounge Baccarat.

Liveshower

Ett underhållande spelkoncept där en programledare snurrar ett hjul, delar ut bonusrundor och pratar med spelarna. De mest kända spelen är Sweet Bonanza Candyland, Wheel of Fortune och Snakes & Ladders Live. Dessa finns i avdelningen Game Shows, och kan spelas både i demoläge och live från studiomiljö.

Liveblackjack

Det klassiska spelet 21 – spela mot en riktig dealer i realtid. Casinon utan svensk licens erbjuder tiotals livebord: Blackjack Azure, Ruby Blackjack, Speed Blackjack m.fl.

Andra typer av spel hos online casinon utan svensk licens

Letar du efter nya spel hos casinon utan svensk licens? Då bör du titta på följande spelkategorier. Alla är lika rättvisa som klassiska slots eller bordsspel, men skiljer sig i spelmekanik och spelupplevelse. Testa dem!

Keno

Keno är ett nummerspel där du väljer mellan 1 och 10 nummer och väntar på vilka som dras i varje omgång. Ju fler träffar, desto högre vinst. Både klassisk och snabbversion finns hos casinon utan licens i Sverige. Den mest populära versionen enligt spelare är Kenospelet från Spribe, där du kan vinna upp till €10 000 på en insats på bara €1.

Lotto

Liknar traditionell bingo. Målet är att markera specifika nummer på en bricka – till exempel alla diagonalt eller horisontellt. Lotto finns både som automatisk version och med livevärd, ofta med jackpottar och bonusfunktioner.

Bingo

Väldigt populärt i Norden som TV-format, men ännu mer engagerande i casinoversion. Du får en spelbricka, och siffror dras en i taget. Målet är att fylla en rad eller hela brickan. Onlinebingo hos casinon utan Spelpaus erbjuder turneringar och flera varianter: 30-ball, 75-ball och 90-ball.

Crash-spel

I crash-spel ökar multiplikatorn tills ett slumpmässigt "kraschläge" aktiveras. Ditt mål är att ta ut vinsten innan kraschen sker. Mest populära spel är JetX, Aviatrix, Chicken Road, Rocketon och Mines. Reglerna är lika, men designen varierar. Extra uppmärksamhet förtjänar Plinko – ett enkelt och populärt spel hos casinon utan svensk licens. Du släpper ner en boll och fångar multiplikatorn längst ner på en bräda med piggar.

Dessa spel är populära för sin unika spelupplevelse och sina Provably Fair-mekanismer. Multiplikatorn bestäms innan rundan startar och kan inte ändras i efterhand eller förutses.

Sportspel hos casinon utan licens i Sverige

Det är mycket bekvämt att ha tillgång till sportspel direkt från samma saldo där du spelar casinospel. Alla populära europeiska och internationella ligor och sporter (fotboll, tennis, basket, ishockey, skidskytte, simning m.m.) är tillgängliga för lagliga odds, vilket du inte hittar hos casinon med svensk licens och BankID.

Trots att 42 % av deltagarna i en offentlig undersökning i början av 2026 anser att man bör välja spel med svensk licens, föredrar ändå majoriteten internationella spelbolag.

Bästa casinon efter spelutbud

| Casino | Antal slots | Live-spel | Genomsnittlig RTP | Spelleverantörer |

| Instant Casino | 6 500 | 250 | 97,5 % | Över 80 |

| Golden Panda | 6 000 | 200 | 96,8 % | 78 |

| Lucky Block | 4 500 | 150 | 96,49 % | 55 |

| Mega Dice | 6 000 | 180 | 96,4 % | 69 |

| 24Slots | 5 000 | 160 | 96,2 % | 55 |

Vad utmärker slots hos casinon utan svensk licens?

Det viktigaste kännetecknet för onlinecasinon utan svensk licens är att spelen erbjuder högre RTP, vilket gör dem mer lönsamma för spelaren. Vi rekommenderar att du väljer slots med RTP över 96 % för att öka dina vinstchanser. Även om RTP är en statistisk indikator ger det dig ändå bättre odds. Tänk även på spelens volatilitet – hög volatilitet innebär färre men större vinster.

Inga spelpauser i spelen

Hos casinon utan svensk licens finns inga obligatoriska spelpauser mellan snurr, vilket är ett krav hos licensierade svenska casinon. Enligt Spelinspektionens regelverk måste spelaren vänta minst tre sekunder mellan varje snurr. Det är tänkt att minska speltempot, men många spelare upplever det som irriterande.

Hos internationella casinon spelar du i ditt eget tempo – utan pauser, nedräkningar eller automatiska begränsningar. Det finns autoplay- och turbo-lägen där hjulen snurrar automatiskt, och vinster kan utlösas direkt vid nådd multiplikator. Det är faktiskt säkrare än det låter, så länge du har koll på din insats och ditt spelbeteende.

Trygga spelleverantörer hos casinon utan svensk licens

Tillgång till välrenommerade spelleverantörer är en garanti för kvalitet och rättvisa. Det är leverantören, inte casinot, som ansvarar för mjukvaran bakom en slot eller ett live-spel. Casinot kan inte manipulera vinstchanser i licensierade spel – allt styrs av leverantören. Pålitliga aktörer erbjuder också demoversioner av sina slots som du kan spela gratis, utan registrering.

Här är 5 av de mest pålitliga leverantörerna som ofta finns hos casinon utan svensk licens:

- Pragmatic Play – kända slots som Sweet Bonanza, Gates of Olympus, samt spelshower och live baccarat.

- Evolution – ledande inom livecasino, skapare av Lightning Roulette, Crazy Time, Blackjack Azure.

- Hacksaw Gaming – moderna crash-spel och slots med hög volatilitet som Wanted Dead or a Wild.

- Play’n GO – populära i Norden, utvecklare av Book of Dead och Reactoonz.

- NoLimit City – innovativa slots med höga utbetalningar, exempelvis Mental och xWays Hoarder.

Välj casinon som samarbetar med dessa varumärken – då får du säkra spel, rättvisa algoritmer och skyddade vinster.

Begränsat utbud hos svenska casinon

En av de tydligaste skillnaderna mellan svenska casinon och internationella alternativ är det begränsade urvalet av leverantörer. Anledningen är Spelinspektionens strikta regler – endast spelstudior som uppfyller särskilda svenska krav på säkerhet, spelfrekvens, spelarskydd och till och med bonusstruktur får tillstånd att vara aktiva i Sverige.

Betalningsmetoder och uttag hos casinon utan svensk licens

Hos casinon utan svensk licens finns betydligt fler betalningslösningar jämfört med licensierade svenska casinon. Spelare kan använda bankkort (Visa, Mastercard), internationella e-plånböcker (Skrill, Neteller, Jeton, MiFinity) samt kryptovalutor som BTC, USDT, ETH och fler. Många casinon stöder även anonyma eller P2P-betalningar som gör det möjligt att sätta in pengar utan verifiering via BankID.

Betalmetoder kopplade till svenska banker och ID-system som Trustly, Zimpler, Klarna och Swish är inte tillgängliga hos casinon utan Spelpaus sedan 2019. Dessa tjänster samarbetar endast med operatörer som har svensk licens. Därför bör du i förväg förbereda alternativa betalmetoder – till exempel kryptoplånbok eller ett Skrill-konto.

I följande avsnitt går vi igenom de snabbaste uttagsmetoderna, gränser för utbetalning, verifieringskrav och ger konkreta rekommendationer för säkra uttag från casinon utan licens i Sverige.

Debet- och kreditkort

De flesta spelare har redan bankkort, och dessa kan i teorin användas för både insättningar och uttag – casinon utan svensk licens accepterar kort från svenska banker. Men transaktionerna är spårbara, och banken kan be om förklaring till inkomster. Det finns inga juridiska hinder, men du bör vara beredd på kontroll från Skatteverket. Uttag via Visa och Mastercard är också långsammare än andra metoder. Vi rekommenderar att använda förbetalda kort eller e-plånböcker för bättre anonymitet och snabbare hantering.

Banköverföring

Banköverföring är ett sätt att ta emot större vinster direkt till ditt konto. Detta alternativ passar om du redan verifierat din identitet och vill göra ett tydligt uttag. Det är långsamt, men praktiskt för att ta emot större summor. Observera att svenska banker ofta begär information om pengarnas ursprung, särskilt vid belopp över 10 000 SEK.

Tänk på följande alternativ:

- SEPA – snabba överföringar inom EU med låg avgift.SWIFT – används för internationella utbetalningar i USD eller EUR.

- IBAN – krävs för att ange mottagarkonto vid uttag i euro.

Förbetalda kort (Paysafecard)

Om du vill sätta in pengar anonymt och inte ange bankuppgifter är förbetalda kort ett utmärkt alternativ. Paysafecard köps i butik eller online och används genom att ange en kod i casinots kassa. Det är säkert, snabbt och kräver inget konto. Tänk dock på att vinster inte kan tas ut till Paysafecard – du måste använda en annan metod.

Tillgängliga alternativ:

- Paysafecard – mest använda.

- Flexepin – liknande system, populärt i Europa.

- Neosurf Voucher – kräver ingen registrering eller KYC.

Kryptovalutor

Kryptovaluta är inte bara ett alternativ – det är ett fullvärdigt betalningsmedel. Vissa av de bästa kryptocasino utan svensk licens använder enbart krypto för både bonusar och uttag. Ingen identitetsverifiering krävs. Uttag är snabba, och avgifterna är minimala. Det viktigaste är att hantera din plånbok korrekt och dubbelkolla adressen innan överföring. Krypto är också det bästa sättet att undvika bankbegränsningar om du inte vill att dina transaktioner ska spåras.

Vanliga kryptovalutor:

- Bitcoin (BTC)

- Ethereum (ETH)

- Tether (USDT) – särskilt rekommenderad

- Litecoin (LTC)

- BNB, XRP, TRX.

E-plånböcker

För snabbast möjliga insättningar och uttag är e-plånböcker oslagbara. Med en e-plånbok kan du sätta in pengar till casinon utan svensk licens omedelbart och ta ut vinster inom 15 minuter. E-plånböcker ger dessutom bättre kontroll över din spelbudget och transaktionshistorik samt möjliggör insättningsgränser.

Rekommenderade alternativ:

- Skrill – snabba betalningar och högt tak.

- Neteller – populärt bland spelare, erbjuder eget kort.

- Jeton – modern och användarvänlig.

- MiFinity – fungerar även utan fullständig KYC.

- MuchBetter – optimerat för mobilcasino.

- AstroPay – kombinerar vouchers och plånbok.

- Neosurf – anonym insättning med värdecheck.

Fintech-konton (Revolut, Wise)

Revolut och Wise är inte banker, men fungerar på samma sätt – bara enklare. Du får ett konto med IBAN och kort som kan användas för casinospel. Fördelar: omedelbara betalningar, flera valutor och låga avgifter. Dessa konton är ofta accepterade för både insättning och uttag, särskilt hos kryptobaserade eller europeiska casinon. Perfekt för dig som vill hålla spelbudgeten separat.

Vi rekommenderar:

- Revolut – mobilapp med multivalutakort.

- Wise – stabila överföringar inom EU med låga avgifter.

- Monese – enkelt alternativ utan krångel.

- N26 – populärt i EU, fungerar i de flesta länder.

- Paysend – direktöverföringar till kort eller konto.

Alternativa metoder hos casinon utan svensk licens

Dessa metoder är ovanliga men kan vara användbara. PayPal stöds sällan eftersom tjänsten har strikta regler för spel om pengar – men är lagligt där det accepteras. Mobilbetalningar kan fungera för små insättningar utan kort, men tillåter inte uttag. Använd dem därför bara som tillfällig lösning.

Alternativ som ibland förekommer:

- PayPal – begränsat stöd, ibland via tredje part.

- Boku – möjliggör insättning via mobiloperatör.

- Siru Mobile – liknande Boku, insättningsgräns ca €30.

- Apple Pay / Google Pay – ofta tillgängliga i casinon utan svensk licens.

Betalningsmetoder som inte fungerar hos casinon utan BankID

Om du är van vid att använda Trustly, Swish, Zimpler eller Klarna hos svenska onlinecasinon, bör du veta att dessa betalmetoder inte är tillgängliga hos casinon utan svensk licens. De fungerar enbart med operatörer som är registrerade i Sverige och kopplade till BankID-systemet. Det är både ett tekniskt och juridiskt krav – om du försöker göra en betalning till ett internationellt casino kommer transaktionen att avvisas automatiskt eller blockeras av betaltjänsten.

Denna begränsning fastställs i lagen om spellicensiering – Spelregleringslagen (SFS 2018:1138), som reglerar hela betalningsinfrastrukturen för licensierade aktörer. Mer information finns på Spelinspektionens officiella webbplats.

Hos internationella casinon kan du inte använda svenska betalmetoder – men det finns pålitliga och beprövade alternativ som vi rekommenderar.

- Trustly fungerar endast i kombination med BankID och används för omedelbara insättningar och uttag hos svenska casinon. Utanför Sverige är Trustly inte integrerat. Vi rekommenderar att du använder Skrill eller Neteller – båda stödjer snabba överföringar, uttag behandlas inom 15 minuter och kontoverifieringen är förenklad.

- Swish är ett mobilt betalningssystem som är helt kopplat till svenska banker och BankID. Casinon utan licens kan inte ens ansöka om att använda det. Vi rekommenderar i stället: MiFinity (stödjer SEK och ger nästan omedelbara uttag), Jeton Wallet (fungerar inom hela EU) eller förbetalda vouchers som Neosurf.

- Zimpler stödde tidigare internationella överföringar, men sedan 2023 samarbetar företaget endast med casinon med svensk licens. Vi rekommenderar att du använder Revolut eller Wise – båda tjänster ger virtuella kort, multivalutakonton och fungerar oberoende av svenska banker. Perfekt för dig som vill spela i euro eller USDT.

- Klarna erbjuder inte längre uppskjutna betalningar för spel utanför Sverige. Företaget har helt avslutat sitt stöd till iGaming-branschen utanför den svenska marknaden. Om du föredrar mobilbetalning kan du istället använda kryptovalutor (USDT, LTC) eller fintech-appar som MuchBetter, där du kan ladda kontot med kort och hantera saldot i appen.

Bästa casinon utan svensk licens för uttagsmetoder och gränser

Vilka casinon utan svensk licens har de snabbaste uttagen och vilka betalningsmetoder erbjuder de? Här är en sammanställning i tabellform:

| Casino | Tillgängliga uttagsmetoder | Genomsnittlig uttagstid |

| Instant Casino | Skrill, Neteller, BTC, SEPA, Jeton, Apple Pay, Visa, Mastercard | 15 minuter – 24 timmar |

| Glitchspin | BTC, ETH, USDT, Skrill, MiFinity, Paysafecard, Mastercard | upp till 1 timme |

| Golden Panda | Skrill, Neteller, Visa/Mastercard, Banköverföring, MiFinity, Blik, Google Pay, Apple Pay | 1–2 arbetsdagar |

| Lucky Block | BTC, ETH, USDT, BCH, BNB, DOGE, ETC, SOL, TRX, ZEC | 15 minuter – 12 timmar |

| Mega Dice | BTC, USDT, ETH, Telegram Bot, WalletConnect (över 30 kryptovalutor) | omedelbart – 1 timme |

Topp 5 bästa casino utan svensk licens – detaljerade recensioner

Nu går vi igenom de bästa online casino utan svensk licens som har visat sig vara pålitliga och rättvisa. Alla recensioner är objektiva, baserade på våra redaktörers erfarenhet, bekräftade av svenska spelares omdömen och expertbetyg.

Hittat ett fel? Lämna gärna en kommentar eller kontakta vår redaktör!

Instant Casino – bästa spelsajten utan svensk licens 2026

Instant Casino toppar vår lista tack vare stabil drift, stort spelutbud och transparenta utbetalningsvillkor. Detta internationella online casino har ingen svensk licens, vilket innebär att svenska spelare kan kringgå Spelpaus-begränsningar. Casinot erbjuder den största välkomstbonusen: 200 % upp till €7 500, aktiveras vid första insättning från €20. Omsättningskravet är x15 på insättningen – bättre än hos många andra aktörer. Bonusen delas upp i delar – varje insättning under 7 dagar ger en ny del.

Utöver startbonusen får du 10 % cashback varje vecka på nettospel i casino och sport – helt utan omsättningskrav, vilket är ovanligt hos casino utan svensk licens.

Instant Casino har licens från Anjouan (Union of Comoros) och erbjuder över 5 000 spel från ledande leverantörer som Pragmatic Play, Play’n GO, Hacksaw, Blueprint m.fl. Casinot är tillgängligt via både dator och mobil, och gränssnittet finns på flera språk, inklusive engelska, finska och norska (inte svenska).

Insättningar kan göras med Visa, Mastercard, Apple Pay, kryptovalutor (BTC, ETH, LTC) samt via MiFinity och Jeton. Minsta uttag är €20, uttag behandlas inom 15 minuter till 24 timmar. Kundtjänst är snabb och tillgänglig via chatt och e-post.

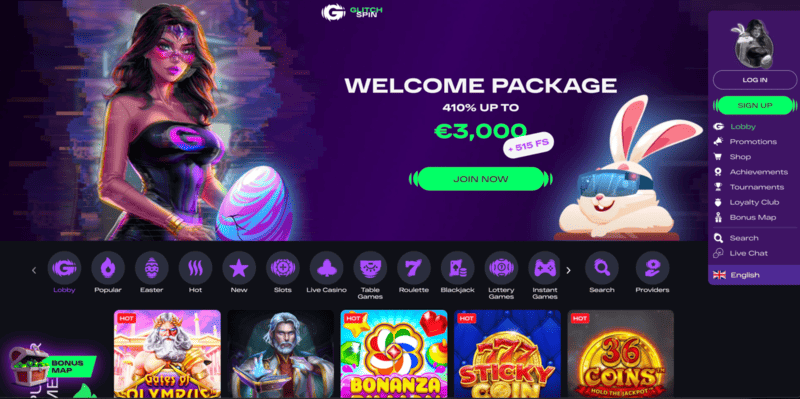

Glitchspin – nytt casino utan svensk licens

Glitchspin är ett nytt casino utan svensk licens med fokus på design, användarupplevelse och spelarnas personliga framsteg. Det erbjuder mer än bara slots – det är en komplett spelmiljö där varje steg belönas. Registreringen tar 1–2 minuter, och svenska spelare är välkomna utan blockeringar.

Bonussystemet är Glitchspins stolthet. Startpaketet är 410 % upp till €3 000 + 515 free spins. Dessutom finns reloadbonusar för storspelare, veckovisa kampanjer, 10 % cashback upp till €200 och turneringspriser. Bonusnivåerna beror på spelaraktivitet. Ett internt "Shop"-system gör det möjligt att växla poäng till spins och kontantbonusar.

Spelutbudet imponerar: över 4 000 slots, bordsspel och livecasino från Pragmatic Play, Evolution, Play’n GO, Wazdan, TrueLab, Winfinity, BGaming och fler. Bland live-spelen finns både klassiker och shower som Monopoly Live och Crazy Pachinko.

Casinot har licens från Curaçao, och stöder betalningar via Skrill, Paysafecard, MiFinity, kryptovalutor och banköverföring. Verifieringsprocessen är enkel – endast vanliga ID-dokument krävs. Spelare i Sverige lämnar överlag positiva omdömen.

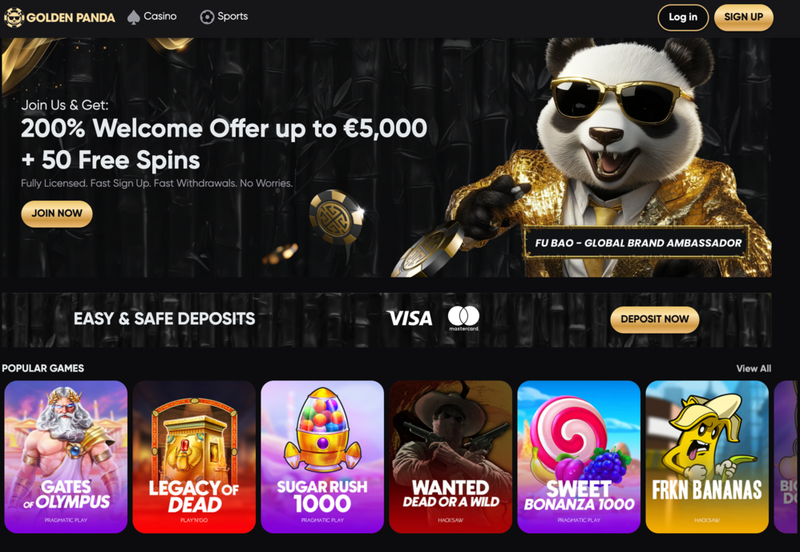

Golden Panda – casino utan svensk licens med bonus upp till €5 000

Golden Panda är ett nytt men pålitligt casino som accepterar svenska spelare utan krav på BankID. Allt är enkelt: snabb inloggning, tydligt gränssnitt, transparenta bonusvillkor. Välkomstbonus: 200 % upp till €5 000 + 50 free spins – gäller endast på slots. Uttag kräver omsättning på 30x bonusbeloppet.

Cashback-funktionen är ett stort plus: upp till 10 % varje vecka på nettospel. Om cashbacken överstiger €10 000 får du en personlig VIP-manager. Casinot stöder alla populära betalningsmetoder: Visa, Mastercard, Apple Pay, Google Pay, Bitcoin och lokala alternativ som Blik – svenska betalmetoder är förstås inte tillgängliga.

I slotkatalogen hittar du de bästa leverantörerna: Pragmatic Play, Hacksaw, Play’n GO, Octoplay, Novomatic m.fl. Spelen är kategoriserade, nya titlar markeras tydligt. Casinot har licens från Anjouan (Union of Comoros), licensnummer ALSI-1423 | 1005-FI2 (verifierat av oss).

Lucky Block – kryptocasino med uttag på 15 minuter

Lucky Block är ett globalt kryptocasino från samma grupp som Instant. Ingen BankID-verifiering, ingen svensk licens – men allt en spelare behöver: hög bonus, snabba uttag i krypto, Telegram-access och stort spelbibliotek.

Välkomstbonus: 200 % upp till €25 000 + 50 free spins – en av de högsta bonusarna bland casino utan svensk licens. Cashback: 15 % på nettospel.

Insättningar och uttag via alla populära kryptovalutor: BTC, ETH, LTC, USDT, BNB m.fl. Du kan även köpa krypto direkt med kort genom funktionen Buy Crypto – utan att lämna casinot.

Spelutbudet kommer från toppleverantörer som Hacksaw, Pragmatic Play, Relax, Play’n GO, Push Gaming, Novomatic. Fokus ligger på kryptospel, snabba spel och turneringar. Det finns en egen Plinko Casino-kategori samt spel via tokenen $LBLOCK. Live dealers, jackpottar och hundratals automater ingår också.

En unik funktion är Telegram-communityt, där spelare får bonusar, nyheter och deltar i utlottningar.

Mega Dice – pålitligt kryptocasino tillgängligt i Sverige

Mega Dice erbjuder spel, bonusar och uttag helt i kryptovalutor. Över 2 000 spel från Pragmatic Play, Hacksaw, Push Gaming m.fl. Fokus ligger på snabba uttag via USDT, BTC, ETH, TRX och fler. Insättningar sker direkt via kort genom en integrerad krypto-gateway.

Registreringen är direkt och utan BankID. Välkomstbonus: 200 % upp till 1 BTC + 50 free spins samt 15 % cashback varje vecka – helt utan omsättningskrav.

Varför utländska casinon inte ansöker om svensk licens: viktiga orsaker

Internationella online casinon väljer ofta att stå utanför den svenska spelmyndighetens jurisdiktion. Det finns flera tydliga skäl till varför de inte vill ha licens från Spelinspektionen – och enligt vår bedömning är det fullt motiverat:

- Strikta bonusbegränsningar – endast en välkomstbonus tillåts, inga cashback-erbjudanden, inga lojalitetsprogram eller återkommande kampanjer.

- Förbud mot VIP-program – casinon med svensk licens får inte belöna spelare för aktivitet.

- Begränsningar i marknadsföring – lagen förbjuder aggressiv reklam, retargeting och kräver varningar i varje kampanj.

- Obligatorisk anslutning till Spelpaus – alla licensierade operatörer måste blockera spelare som aktiverat självavstängning.

- Registrering via BankID – inte alla vill verifiera sig med statliga system.

- Höga skattesatser – licensierade casinon betalar 18 % skatt på spelintäkter från svenska spelare.

- Komplexa betalningsflöden – endast vissa leverantörer som Trustly och Swish är godkända.

- Obligatorisk lokalisering – sajten och supporten måste vara på svenska och tillgänglig lokalt.

- Regelbundna kontroller och rapporteringskrav – casinon måste regelbundet redovisa finansiella och tekniska uppgifter till Spelinspektionen.

- Juridiska risker – minsta avvikelse från regelverket kan leda till böter eller indragen licens. Ansökningsprocessen är tung och byråkratisk.

De mest pålitliga internationella spellicenserna

När du väljer ett casino utan svensk licens är det avgörande att det ändå regleras av en licensmyndighet. En licens är inte en formalitet – den visar att casinot har granskats, måste förvara spelarnas pengar separat och följer tydliga regler för RTP, bonusar och uttag. Nedan är fem av de mest respekterade licenserna inom online gambling med exempel och länkar till offentliga register där du kan kontrollera licensen.

Curaçao eGaming

Licensen från Curaçao är den mest använda i branschen. Den erbjuder grundläggande tillsyn och används av mer än 61 % av alla utländska casinon, särskilt kryptocasino. Trots lägre tröskel kräver Curaçao eGaming rättvist spel, korrekt programvara och datasäkerhet. Du kan verifiera ett casinos licens direkt på tillsynsmyndighetens hemsida.

Malta Gaming Authority (MGA)

MGA är en av de strängaste licensmyndigheterna i Europa. En MGA-licens innebär att casinot har kontrollerats på alla nivåer – från RTP och betalningar till ansvarsfullt spelande. Regulatorn kan stänga ner operatörer som bryter mot reglerna. För spelare är detta en av de säkraste licenserna.

Gibraltar Regulatory Authority

Gibraltar licensierar ett begränsat antal operatörer men ställer mycket hårda krav. Licensen förekommer ofta hos välkända spelbolag och internationella casinon. Regulatorn övervakar betalningar, penningtvätt och ansvarsfull marknadsföring. Allt är lagligt och extremt tillförlitligt.

Isle of Man Gambling Supervision Commission

Licensen från Isle of Man har högt förtroende och strikt tillsyn. Operatörer måste regelbundet genomgå revision, och spelarnas pengar hålls på separata konton. Det är en av de bästa lösningarna för spelarskydd i Europa.

Kahnawake Gaming Commission

Kahnawake är en licens från Kanadas urfolk och har funnits sedan 1999. Den reglerar pokerrum, kryptocasino och hybridplattformar. Trots något mer flexibla krav granskas RNG, uttagsvillkor och operatörens rykte noggrant.

Jämförelsetabell över pålitliga spellicenser

| Licens | Tillsynsnivå | Antal casinon | Skatt på vinst |

| Curaçao eGaming | Grundläggande kontroll | 1 000+ | 30 % |

| Malta Gaming Authority (MGA) | Sträng tillsyn | 350+ | 0 % |

| Gibraltar Regulatory Authority | Högsta kontrollnivå | 50+ | 0 % |

| Isle of Man GSC | Utökad spelarsäkerhet | 40+ | 30 % |

| Kahnawake Gaming Commission | Oberoende jurisdiktion | 60+ | 30 % |

Hur väljer man det bästa casino utan svensk licens?

Är du redo att spela på ett casino utan svensk licens och vinna riktiga pengar? Vi hjälper dig att välja rätt webbplats och undvika vanliga misstag. Här är en checklista med viktiga kriterier för att bedöma ett onlinecasino:

Licens och reglering

Det första du ska kontrollera är om casinot har en internationell spellicens. Casinon med licens från Curaçao, Malta eller Gibraltar verkar under tydlig tillsyn och måste följa krav på KYC, datasäkerhet och säkra betalningar. Detta är särskilt viktigt när du spelar för riktiga pengar och förväntar dig snabba uttag.

Se till att licensen är verifierbar via regulatorns officiella sajt – seriösa casinon anger licensnummer i sidfoten och länkar till verifiering. Saknas denna information är det en varningssignal. Föredra casinon med giltig licens och goda omdömen från spelare och internationella källor.

Betalmetoder och uttagshastighet

En viktig faktor är hur smidigt det är att sätta in och ta ut pengar. Hos casino utan svensk licens kan du vanligtvis använda kryptovalutor, e-plånböcker, Visa/Mastercard samt betalmetoder som MiFinity eller Revolut. Fördelen är att dessa inte påverkas av de svenska begränsningarna.

Det är också avgörande hur snabbt uttagen behandlas. På seriösa casinon sker detta inom några timmar eller senast inom 1–2 arbetsdagar. Om sajten dröjer med uttag, kräver komplicerad verifiering eller inte anger tydliga villkor – bör du undvika den.

Bonusar, cashback och kampanjer

Många väljer casinon utan svensk licens just på grund av generösare bonussystem. Här får du inte bara välkomstbonusar, utan också cashback, reload-bonusar, free spins för kampanjer, turneringspriser och VIP-presenter.

Men stirra dig inte blind på siffrorna. Läs villkoren noga: vilken omsättning krävs, hur lång tid har du på dig, vad är maxgränsen för vinst från bonus? De bästa casinona erbjuder rimliga villkor – exempelvis omsättningskrav på upp till x30 och transparent bonusstruktur.

Spelutbud och leverantörer

Se hur många slots och live-spel som erbjuds och vilka leverantörer som samarbetar med casinot (leta efter Pragmatic Play, Hacksaw Gaming, Nolimit City, Evolution m.fl.). Kända leverantörer signalerar att casinot har goda branschrelationer och hög trovärdighet.

Kolla även hur sajten är strukturerad – finns det demospel, laddas spelen snabbt, fungerar sidan på mobilen? Det bästa casinot erbjuder inte bara mängder av spel, utan även en smidig upplevelse – inklusive filter, favoritlistor och sökfunktioner.

Framtidsutsikter: spelmarknaden i Sverige

Marknaden för casino utan svensk licens fortsätter att växa, trots ökande reglering från Spelinspektionen. Allt fler svenska spelare väljer utländska casinon – både på grund av lokala begränsningar (som insättningsgränser, BankID och bonusförbud) och tack vare attraktiva fördelar hos utländska varumärken, såsom större kampanjer, anonyma insättningar och friare spelmiljö.

Enligt Spelinspektionens rapport 2024 har över 28 % av svenska online-spelare använt ett casino utan licens minst en gång. Andelen är särskilt hög bland unga vuxna och användare som föredrar kryptobetalningar.

Observera infografiken – källa: Offentlig enkät om spelbeteende, 2024.

Vad väntar framöver: blockeringar, förbud och skärpt kontroll

Slutsats

Att välja ett casino utan svensk licens är ett lagligt sätt att kringgå Spelinspektionens restriktioner och få tillgång till tusentals spel, bonusar, cashback, VIP-program – och framför allt friheten från BankID, Spelpaus och insättningsgränser. Just därför är det extra viktigt att vara noggrann i ditt val: kontrollera licensen, bonusvillkoren, uttagsmetoderna och varumärkets rykte.

Vi har granskat de bästa plattformarna för 2026 – från kryptocasino som Lucky Block till det klassiska och mångsidiga Instant Casino – och gett steg-för-steg-rekommendationer för hur du hittar ett säkert och seriöst casino utan svensk licens. Ja, marknaden förändras: fler blockeringar införs och myndigheterna skärper reglerna. Men med rätt strategi kan du fortfarande spela lagligt, förmånligt och på dina egna villkor. Kom ihåg: kontrollera alltid fakta, spela ansvarsfullt och välj endast pålitliga sidor.

Känner du att spelandet tar över? Kontakta en expert! Skriv till oss – vi hjälper dig vidare och förser dig med relevanta resurser.

Vanliga frågor

Hur väljer jag ett licensierat casino utan spelpaus?

Kontrollera att casinot har en internationell licens (t.ex. från Curaçao eller MGA), att det inte är anslutet till Spelpaus, och att registrering inte kräver BankID. Granska bonusvillkor, kryptostöd och uttagstider.

Hur vet jag att ett casino utan svensk licens är säkert och pålitligt?

Verifiera licensen på tillsynsmyndighetens webbplats. Läs recensioner, kontrollera att kända spelleverantörer och betalmetoder används. Seriösa casinon har tydliga regler och kontaktinformation i sidfoten.

Vilka bonusar kan jag få på online casinon utan svensk licens?

Alla typer – välkomstpaket upp till €7 500, cashback 10–15 %, free spins, reloadbonusar, turneringar och VIP-gåvor. Observera att bonusar ofta är separata för casino och betting.

Hur kan jag begränsa mitt spelande på casinon utan svensk licens?

Använd självbegränsande funktioner i kontot (insättningsgränser, självavstängning) eller externa verktyg som BetBlocker och Gamban. Du kan också använda särskild programvara för att blockera tillgången.

Vilket är det bästa casinot utan svensk licens 2026 enligt er?

Instant Casino är vår topprankade helhetslösning – pålitligt, snabba uttag och bra bonusar. Bland kryptocasinon rekommenderar vi Lucky Block och Mega Dice.

Hur spelar man utan konto på casinon utan svensk licens?

Använd Pay’n’Play – direktinloggning och insättning via fintech-plånböcker (MiFinity, Jeton, Revolut). Ingen separat verifiering krävs. Historik sparas dock inte, och efter avslutad session måste du börja om från början.

Finns det bonusar utan omsättningskrav på casinon utan svensk licens?

Ja – till exempel erbjuder Instant Casino cashback utan omsättningskrav (10–15 %) samt free spins och gåvor som kan användas direkt. Läs alltid villkoren noggrant.

Vilka är de minsta uttagen på casinon utan svensk licens?

Vanligtvis från €20. För kryptovalutor är gränserna ännu lägre: t.ex. 0.0002 BTC eller $10 i USDT.